East China’s Jiangsu province recently issued a document to give full play to the role of the financing guarantee system to support small and micro enterprises and agricultural business entities that have encountered increasing difficulties under the impact of the covid-19 epidemic.

Jiangsu will increase financial support and encourage financing guarantee institutions to give priority to providing guarantee and credit enhancement for the financing of small and micro enterprises and agricultural business entities that have insufficient loan credit records and valid mortgages but have marketable products, promising projects, and competitive technologies.

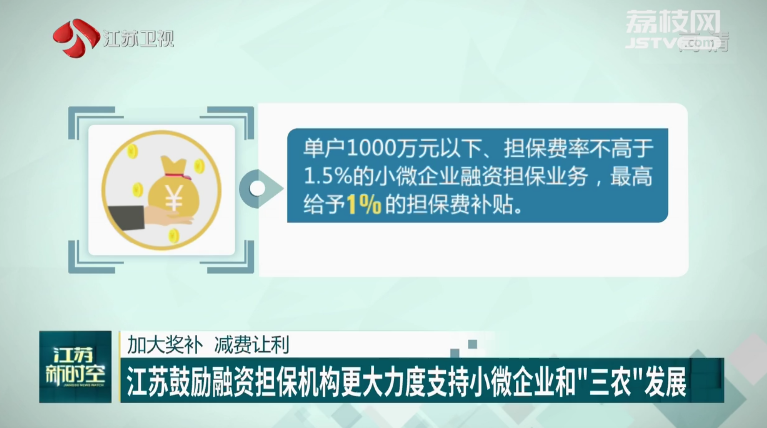

Jiangsu will provide a guarantee fee subsidy of up to 1% for financing guarantee institutions that provide financing guarantee services to small and micro enterprises with a single operating entity of less than 10 million yuan and a guarantee rate not higher than 1.5%.

Jiangsu will provide up to 50% of the financial subsidy for the guarantee business provided by guarantee institutions for grain and oil production enterprises, pig farms, vegetable planting agricultural enterprises, and high-tech enterprises.

Jiangsu will improve the risk compensation mechanism by providing 30% risk compensation for the 10-30 million yuan guarantee business carried out by financing guarantee institutions that support small and micro enterprises and agricultural business entities.

Jiangsu will also strengthen the government financing guarantee system, promote innovation in guarantee business and new government-bank cooperation loans, and strive to issue more than 100 billion yuan of preferential loans throughout the year.