East China’s Jiangsu province has made every effort since the start of this year to promote cross-border e-commerce imports and exports. Let’s take a close look.

At the customs declaration hall of Xuzhou Comprehensive Bonded Zone, with the system displaying the words "bank tax deduction successful, customs verification successful", the first cross-border e-commerce retail import tax form submitted by Jiangsu Falei International Trade Co., Ltd. in Xuzhou has completed electronic payment, making it one of the first batch of cross-border e-commerce retail import electronic payment taxes in Jiangsu.

“Previously, it took at least two to three working days to complete a tax payment. Now, with the accessibility of the electronic payment, the electronic payment transaction for a single tax payment takes less than a minute from initiating a payment request to receiving a successful endorsement receipt from the customs,” said Hu Xin, Deputy Chief of the Customs Tariff Department of Xuzhou Customs.

The electronic payment function of cross-border e-commerce retail import taxes is based on the newly added function of the existing customs new generation tax electronic payment system.

In the past, cross-border e-commerce enterprises had to obtain paper tax receipts from the customs before paying taxes and stamping them at the bank and return them to the customs. The customs verified the actual income of the taxes into the national treasury before verifying the tax receipts, making the entire process very cumbersome.

The electronic payment function has broken the limitations of the original tax payment model in terms of time and space. When receiving the tax invoice information pushed by the customs, the enterprises only need to click in the system window to complete the payment.

“This function includes cross-border e-commerce tax payment, and the new generation of customs tax electronic payment system has expanded the scope of customs tax electronic payment business, allowing enterprises to handle tax payment without leaving their homes,” Dong Hongjun, Deputy Chief of the Customs Tariff Department of Xuzhou Customs, said.

At PayPal Information Technology Company in Suzhou High-tech Zone, various wedding dresses and gowns are being prepared to be shipped worldwide. As a cross-border e-commerce enterprise, the company also faces the tax burden of returning goods.

“E-commerce platforms in various European and American countries return goods without reason within 30 or 90 days. In the past, when one item was returned to us, we often paid tariffs and value-added tax of tens or even hundreds of yuan. Some products are not of high value so that we are more than willing to destroy them overseas,” said.

Tian Haolin, General Manager of Suzhou PayPal Information Technology Co., Ltd.

In order to reduce the export return costs of cross-border e-commerce enterprises, the Ministry of Finance, the General Administration of Customs, and the State Administration of Taxation jointly issued the "Announcement on Tax Policies for Export Return Goods of Cross border E-commerce" in a bid to provide "zero tax burden" policy support for the entry of returned goods by cross-border e-commerce enterprises.

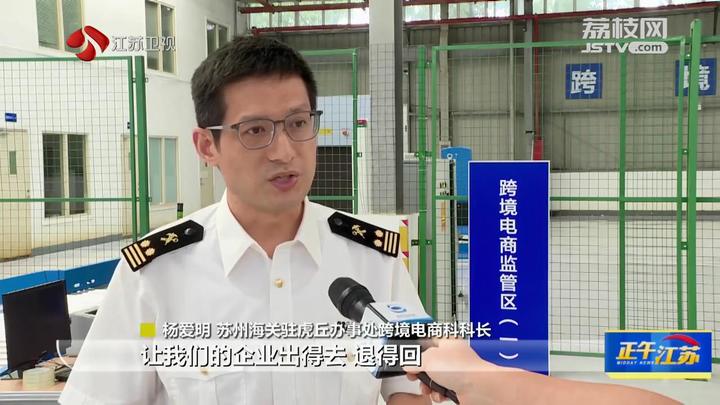

“We have arranged for backbone clerks to visit enterprises and give them instructions on how to handle the declaration of cross-border e-commerce export returns, logistics, and traceability of goods,” Yang Aiming, Head of Cross border E-commerce Department of Suzhou Customs Office in Huqiu, said.

PayPal Information Technology has recently completed the return declaration for a batch of goods destined for Germany, becoming the first batch of goods in the province to be returned and exempted from relevant taxes for the sake of unsaleablity.