The Jiangsu Banking and Insurance Regulatory Bureau recently issued the "Notice on Optimizing the Financing Period Management of Small and Micro Enterprises" in a bid to further alleviate the difficulty of capital turnover for small and micro enterprises.

Jiangsu will give support to self-employed businesses who do not have business licenses but have obtained valid business activity certificates such as market booth certificates, so that more small and micro market players can enjoy favorable credit policies.

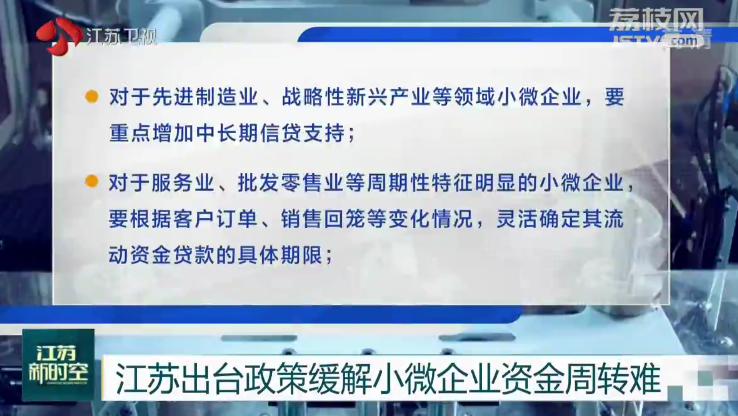

Jiangsu requires all banking institutions to classify and flexibly implement policies according to the operating characteristics, scale and risk status of small and micro enterprises in different industries. For example, for small and micro enterprises in advanced manufacturing, strategic emerging industries and other fields, banks must increase medium and long-term credit support. For small and micro enterprises in the service industry, wholesale and retail industries, banks must flexibly determine the specific term of their working capital loans according to changes in customer orders and sales returns. For inclusive small and micro enterprises that have development prospects but are trapped by the epidemic, banks and enterprises independently negotiate loan principal and interest repayment arrangements.

Jiangsu has also required banks to support small and micro enterprises to "repay as they borrow" according to their capital needs, and pay interest based on the actual number of days the loan is used.

The province has required banks to clean up unnecessary process links, especially to regulate cooperation with third-party loan assistance agencies, and to eliminate various forms of illegal charges.

All banking institutions must continue to improve online financial services, and further simplify the loan process for small and micro enterprises by optimizing online loan application and online approval, electronic signing so as to improve the convenience and accuracy of services.