East China’s Jiangsu province will launch a law enforcement campaign to improve the social credit system in bid to safeguard the civilization progress of modern society and the healthy operation of market economy, according a press conference held Monday by the provincial office for ethical and cultural progress.

In recent years, Jiangsu has advanced and improved the construction of the social credit system with the credit information sharing platform covering 11.11 million market entities and more than 63.5 million individuals in the province.

The provincial public credit information system provided more than 15 million information quest by 13 financial institutions.

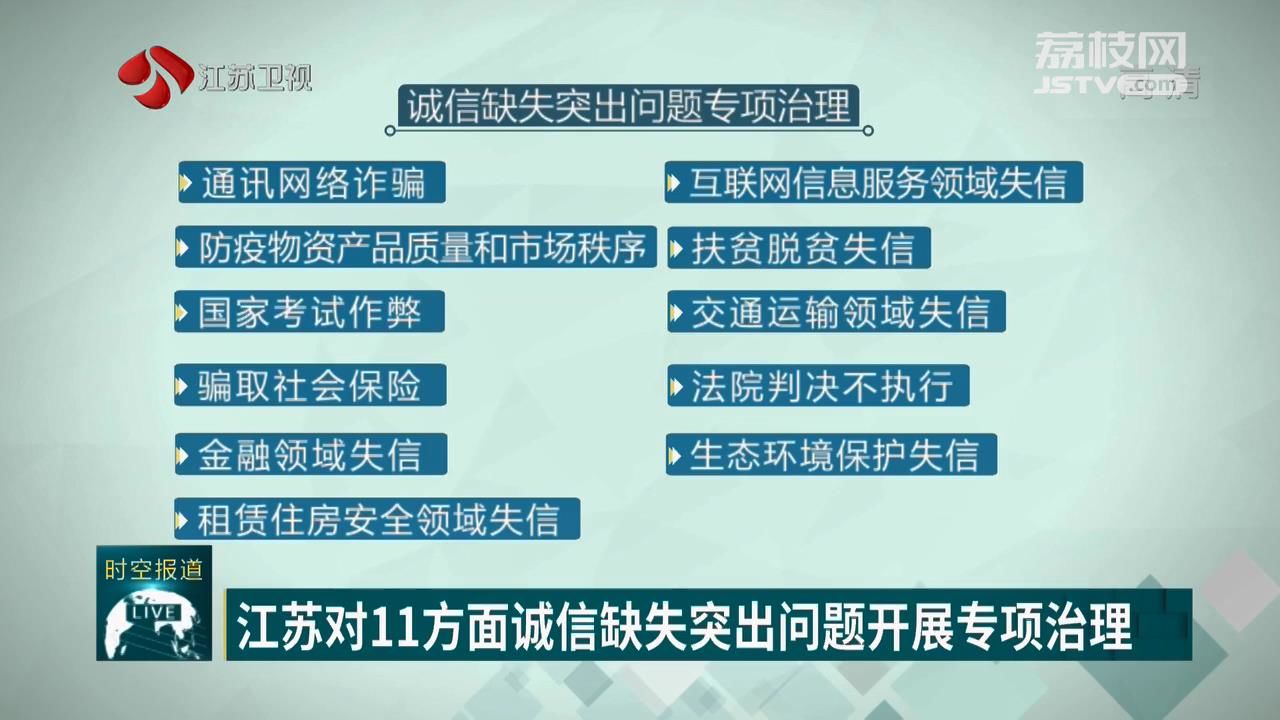

Law enforcement campaign on social credit system will target typical cases of lack of social credit in 11 areas such as communication network fraud, product quality and market order for epidemic prevention materials, cheating in national examinations, and non-enforcement of court decisions.

Li Yuming, Full-time Member of the Judicial Committee and Director of the Executive Bureau, Jiangsu Higher People's Court

The automatic fulfillment rate

of effective judgments is less than 8%

and 36% of the persons subject to execution

are nowhere to be found

Lack of integrity is an important factor

Within this year, the provincial court

will organize 6 major enforcement actions

involving people’s livelihood cases

and crack down on the refusal

to execute effective judgments

to rule crimes in accordance with the law

Wu Zuping, Chief of Criminal Police Corps of Provincial Public Security Department

Since the beginning of this year

telecom-fraud and internet fraud cases

have more than doubled from last year

We handled 497,000 alarms

intercepted 45,000 cases

and retrieved economic losses

of more than 2 billion yuan

China has established the world's largest credit system with the largest amount of data and the widest coverage.

China's credit system has recorded information of 990 million individuals and 25.91 million enterprises and organizations accumulatively, making it the largest in the world.

The system creates credit files for almost all people and enterprises involved in credit activities nationwide in a uniform format, and its products and services were widely used in all aspects of the social economy.

The system has been "irreplaceable in forestalling financial risks and ensuring financial stability," as it was used extensively by financial institutions in loan-related business, said Zhu, adding that commercial banks have embedded data from the system into their risk-management process.

China's credit information index, an important indicator of the business environment, was ahead of some developed countries, according to a report from the World Bank.

China has put a strong emphasis on the building of a social credit system since the State Council issued a guideline in 2014. The country will step up the building of social credit system by rolling out new market regulatory measures.